Challenges and Limitations Why Most Web3 Prediction Markets Struggle to Thrive

Challenges and Limitations: Why Most Web3 Prediction Markets Struggle to Thrive

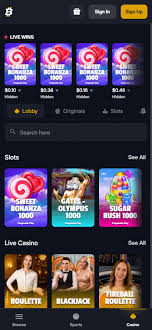

In the evolving landscape of decentralized finance, Web3 prediction markets have emerged as a novel approach to forecasting outcomes across various domains. These platforms leverage blockchain technology to enable users to bet on the outcome of future events, from sports games to political elections. However, despite their innovative potential, many Web3 prediction markets face significant challenges that hinder their growth and adoption. This article aims to explore the most pressing issues that plague these platforms and why many of them struggle to thrive. For those interested in engaging with a promising prediction market, check out Why Most Web3 Prediction Markets Struggle With Liquidity https://bitfortune-app.com/, a platform that navigates these challenges.

The Concept of Prediction Markets

Prediction markets serve as a marketplace for people to buy and sell shares in the outcomes of uncertain future events. These markets are based on the principle of collective intelligence; the aggregate predictions of market participants often prove to be remarkably accurate. In traditional markets, participants can profit by accurately forecasting an outcome, while those who are wrong incur losses. This system creates incentives for information gathering and sharing among participants, which can lead to a more informed prediction market overall.

The Promise of Web3

Web3 represents the next generation of the internet, characterized by decentralized protocols and a focus on user empowerment. By utilizing blockchain technology, Web3 applications offer users greater control over their data and transactions without the need for intermediaries. This shift towards decentralization has paved the way for the emergence of decentralized applications (dApps), including prediction markets. The promise of Web3 technology includes transparency, security, and reduced dependence on centralized authorities, which could revolutionize the traditional prediction market paradigm.

Challenges Facing Web3 Prediction Markets

1. Liquidity Issues

One of the most pressing challenges facing Web3 prediction markets is liquidity. For a market to function effectively, there must be a sufficient volume of participants willing to engage in buying and selling shares. A lack of liquidity can lead to difficulty in entering or exiting positions, resulting in users being unable to place or fulfill bets. This challenge particularly affects new markets that have not yet built a substantial user base. Without liquidity, the price of shares can become volatile, and the market can fail to reflect the true collective knowledge of participants.

2. Regulatory Hurdles

The regulatory environment surrounding prediction markets is fraught with complexity. Governments around the world have various stances on gambling, betting, and financial speculation. In some jurisdictions, prediction markets may be classified as gambling platforms, which could lead to significant legal challenges and restrictions. Furthermore, the decentralized nature of Web3 complicates regulatory compliance as it is often difficult to determine which jurisdiction applies to a given platform. Navigating these regulatory hurdles can deter entrepreneurs from launching new prediction markets or lead to the exit of existing ones.

3. User Engagement and Trust

User engagement is critical for the success of any prediction market. Many users may be unfamiliar with blockchain technology and how to effectively participate in a decentralized platform. Additionally, trust remains a significant hurdle; users need to believe that the outcome reporting mechanism is fair and that their funds are safe. Scandals involving manipulation or fraud in prediction markets can quickly erode trust, making it difficult for new platforms to attract participants. Therefore, building a strong community and fostering trust through transparent mechanisms is essential for the long-term viability of Web3 prediction markets.

4. Lack of Usability and User Experience

The user experience (UX) of many Web3 prediction markets often leaves much to be desired. Complicated interfaces or the necessity of interacting with multiple crypto wallets can deter newcomers. For a prediction market to thrive, it needs to provide a user-friendly experience that requires minimal technical knowledge. If potential users find the process of participating in prediction markets cumbersome or confusing, they are likely to abandon the platform for more straightforward alternatives. Improving UX is crucial to engage a wider audience beyond the existing crypto community.

5. Volatility of Cryptocurrencies

Many prediction markets operate using cryptocurrencies, which are known for their extreme volatility. Users betting on outcomes are often simultaneously exposed to the volatility of the underlying currency, which can lead to significant financial risks. For instance, if a user places a bet with a specific amount of cryptocurrency, subsequent price fluctuations can mean the value of their stake diminishes or increases significantly before the outcome is realized. This unpredictability can deter users from engaging, particularly those new to cryptocurrency and blockchain technologies.

6. Competition from Traditional Markets

Prediction markets are not the only means of forecasting outcomes; traditional betting and financial markets present established alternatives. Many users prefer to engage with these familiar platforms that offer a level of trust and stability that newer decentralized platforms may lack. Moreover, traditional platforms often have greater marketing power and can reach audiences that decentralized platforms may struggle to attract. For Web3 prediction markets to compete effectively, they must leverage their unique advantages and provide compelling reasons for users to switch.

Strategies for Improvement

While the challenges facing Web3 prediction markets are significant, several strategies can be implemented to address them. Enhancing liquidity through partnerships with other platforms or liquidity providers can help create a more robust market environment. Furthermore, building a community around the platform can foster trust and encourage user engagement, while prioritizing UX design can make platforms more accessible to a broader audience.

Conclusion

The Web3 prediction market space holds immense potential, but it is not without its difficulties. By addressing hurdles related to liquidity, regulation, user engagement, usability, cryptocurrency volatility, and competition from traditional markets, prediction markets can pave the way for a more robust and thriving financial ecosystem. Continued innovation combined with efforts to foster trust and engagement will be critical in determining the future success of these platforms in the decentralized world.

Facebook / Twitter

Rua virgílio val n.° 86 - centro viçosa - mg 2° andar

acessar versão móvel

acessar versão móvel